Patrick Campbell, CEO, ProfitWell

Patrick considers why SaaS companies obsessed by User Acquisition and User Acquisition Cost are focusing on the wrong metrics, missing the far more important growth drivers for a SaaS business: monetization and retention.

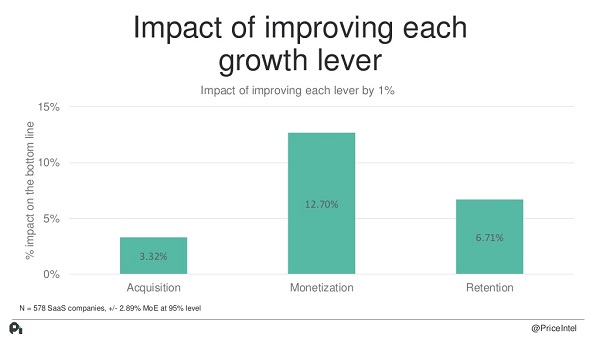

A data rich talk that shows the importance of developing your product in collaboration with your current users to understand the needs of the people that are paying for your product. While user acquisition is important, a 1% improvement in customer monetization or user retention will have 3-4x impact on bottom line over user acquisition.

Slides, Video & Transcript below

Slides from Patrick’s talk here

Video

Learn how great SaaS & software companies are run

We produce exceptional conferences & content that will help you build better products & companies.

Join our friendly list for event updates, ideas & inspiration.

Transcript

Patrick Campbell: I feel like I should start by saying go Sox! We’re a Boston based company so I thought I should put that out there. A little housekeeping first, we will go through a lot of data and pieces of methodology so we find it useful to share the slides and if you have any other needs or wants or anything related to the talk, you just send me an email directly.

Building product is getting harder, not easier

But today what I really want to impact for everyone here today is really this concept of building product is getting harder, it’s not getting easier, and it will continue to get harder as we continue to go into the future. We will unpack the statement but to put it more colloquially the age of throwing sh*t against the wall and seeing what sticks is over. I don’t mean that it’s harder to push code or make pixels do what we want them to do, I’m referring to the fact that it will be harder to build an actual software business.

Before we unpack and support that thesis, who the hell am I? Bold claims, definitely not clean shaven and looking professional. Who am I to make such a bold statement here? We founded price intelligently about 4 years ago and if you give me a bit of a self-indulging moment here actually started as a bootstrapped company around 4 years ago, the BoS Conference that was at the intercontinental. And I remember actually a nice little anecdote here, I emailed Mark. We were broke, I cashed in my 401k and I’m not that old and so it wasn’t that much money. I was like Mark, I want to come to the conference, we have no money, can you give me a break? I remember through a couple of emails back and forth all of a sudden, Dharmesh was like I will sponsor his ticket. Great!

It was one of those things where it’s exciting that we started around 4 years ago around business of software and the BoS conference and it’s been something that’s important to our company and now 4 years later we have 2 suites of software, we are 25 people, still bootstrapped and cranking along. But what’s cool is that on one side of the software is this price intelligently suite of pricing software. So we’ll get into a bit more about what we do later but essentially we help companies with their pricing. So you saw Dharmesh and a couple other speakers talk about it we found this problem, and my background is in economics and maths, and at other software companies where we were so smart about building good product and good marketing campaigns but when it came to pricing, we were like here’s a couple MBAs give them time in a room and they will come with a nice pricing model. We thought there was a better way.

The other suite of software is ProfitWell, and it’s a free subscription financial metrics so you can plug in zora, Braintree, stripe whether you’re using and you get access to your churn and all that kind of fun stuff. We’re helping people as big as Atlassian and Autodesk all the way down to early stage companies. I’m not giving you this context because it’s an update to BOS but because at this point through both pieces of software, we’ve seen inside more software companies than anyone else on the planet. Our current data set sits in our estimate between 15-17% of the entire software market and as we continue to unpack this thesis we were fortunate to see the data earlier on as we continued to see the development of the software industry.

To start unpack this, we will go through a lot of this data, start at a high level macro that we will dig into what we’re seeing from a founder level and then we will make everyone feel better after we make them feel not so great by giving you some tools and tactics that you can use to overcome some of the things we are seeing.

The market is becoming saturated

But to start things off, we notice the market is becoming extremely saturated. It used to be, about 10 years ago, you could have a novel idea like marketing analytics or something like Dropbox and all of a sudden you didn’t have a ton of competitors, there wasn’t a lot of really good software out there and you could really differentiate yourself. We’re seeing those days no longer exist.

First off, our world is becoming extremely competitive, making switching costs even easier. What we did was we went out to some founders who have been around for 5 years and we said what’s going on with your competitors and in your different trajectory – what was your competitor subset, what did it look like? And what we found was, over time, competitors were definitely growing. What’s interesting about this is, of course if they are being successful they were around for 5 years, maybe it’s an indication that they attracted more competitors. In reality what’s happening even with competitors, subsets with companies that are less than 1-year-old, because software is easier to build with not only frameworks but also all kind of software that’s out there for making software, it’s easy to enter the market and most markets that 10 years ago had one archaic competitor that was a perpetual licensed type product now all of a sudden have 6 or more different SaaS competitors that are out there.

The relative value of features is declining

What’s interesting, if you can dig deeper not necessarily on the competitor subset but we look at the individual value of features, we’re seeing that it’s trending towards 0. We’ve all potentially heard of this concept that all concept is going to 0 but we’ve seen the data that proves that or at least supports that.

We will pause a second on the slide cause as it’s a little confusing to walk through. But we have an algorithm for our pricing software. We go out to end users and ask them a few questions and we can take the data and calculate an elasticity curve. Basically an elasticity curve is; what price=what type of volume you will get. If you increase your price 2x we can estimate how much volume you will lose in terms of sales or churn or a number of different factors.

What’s really fascinating is when we normalise that data, meaning we’re able to compare something like Crazy Egg’s core features to Dropbox’s core features or even take some of the different add-on features that a lot of us have been adding to get upgrades – so integrations, analytics, single sign on. We’re noticing that no matter how you slice it, things are going down and to the right. And anecdotally 4 years ago you could charge someone $400 a month for a sales force integration it wasn’t that hard but now it’s expected. Everyone else has a sales force integration and it’s free. Why are you gonna charge me for it?

What’s kind of interesting is when you dig further into this data from the CAC side of the house, we’re noticing that relative CAC is also increasing over time. So we look at a similar customer subset here, both on a B2B and B2C subset, all of a sudden we’re seeing CAC is increasing. Now this should be intuitive, right? Everyone and their mother has an eBook, everyone has got some sort of Facebook ads, CPC’s are increasing over time – this shouldn’t be too surprising. But the problem is when you look at it, competitors and CAC are increasing, willingness to pay is going down overall. It’s becoming harder to succeed.

Good customer driven product is becoming more important

Now if we go a bit further we can state a platitude we all know, that good customer driven product is becoming increasingly important. But the problem that we’re seeing in the market is that us, this ecosystem, and we’re not speaking from some high horse here – we also have problems, we’re really ill equipped for this transition.

We don’t know our buyers.

So when we looked at founders and we talked to a lot of founders and executives in SaaS and we asked them who are your buyer personas? Most of us weren’t able to give a good answer. And I might kind of shoot myself in the foot here, I’m going to do a little bit of an experiment here, it’s more of an advanced group, but how many of you in your businesses have buyer personas? Raise your hands if you have some context of buyer personas. HubSpot has been writing about these for years, like start up Steve – cute little names. For those of who have them, keep your hands raised for a second. How many are in a central document? Anyone on the team can access them? Ok, we lost a few. How many of you have them broken down by different usage or unit economics? So start up Steve are worth this much, this is their CAC and so on? Lost a few more. How many of you have relative value that you collected data about what features are the most important and least important from the customer’s perspective? We have one? A couple more over here. Price elasticity data, for each of your buyers? There we go, that’s the one that kills everything!

What is interesting is what we noticed in the market, is that people don’t have quantified buyer personas. When I talk about quantified buyer personas, it’s not a cute avatar with a cute name. It means you still have those cute avatars and cute little name, but also a lot of data you’ve collected on what are the most valued and least valued features? What’s the willingness to pay for that particular person? And to give you a bit of solace, you’re not alone in not having buyer personas. This is 1600 software companies out there.

Most folks, you thought about it, you know a bit about your buyer and it’s not like you’re starting from scratch but very few of us have this central document even less of us have quantified buyer personas. And you might think it’s ok but here is where it gets scarier for the ecosystem in general. We asked people how many people are you talking to on a monthly basis in a customer development capacity? What’s fascinating? Not a whole lot. The majority of folks are talking to less than 10 target customers per month. And this should be pretty scary because there are fortune 2000 companies in that set, not talking to enough customers. When we present this data to some folks, they say we don’t have official numbers on how we talk to customers but we send a lot of customer development surveys. Nope! Most people aren’t sending surveys, most of them say surveys suck and they suck because we’re bad at sending them. We will talk about them in a bit.

The other feedback I get is we don’t talk to customers and we don’t really go out and send surveys but you know what we do? We test the sh*t out of things, we AB test everything really well. Nope. And what’s really scary about this is this includes marketing tests. To give you some context. So we’re not talking, surveying customers or doing tests and all of sudden we wonder why our businesses aren’t succeeding and the market is getting harder.

We’re obsessed with acquisition

What’s scarier is when we look more into what we focus on as companies – this is what we want to explore, not doing core product these things in software people said are so important. What are we doing? Acquisition, that’s what we’re focusing on. We are stalker level obsessed with acquisition as an ecosystem. And the first data point we looked at to support this, we looked at 26k different blog posts and we did this because we write about what we want to hear and we know what gets us clicks. If someone writes a blog post about the 25 Facebook tips and tricks that we want to see and it gets a lot of traffic, we will write more about that. We looked at articles specifically about growing your business and we found that most were on acquisition. But 8 out of 10 posts are written on that, about 1 out of 10 being about retention and a couple of dozen sadly written mostly by price intelligently about monetisation. When we unpacked this data we were like it’s the nature of SaaS companies out there built for acquisition and we found, holy cow, these are all built for acquiring more customers. Not a lot of folks focusing on retention and I welcome anyone who wants to come and help with monetisation.

Now this might be a chicken or the egg, but I wanted to show you logos, here’s all the retention – those are all the acquisition companies. And what’s interesting – we have a lot of acquisition companies and therefore have a lot of acquisition in blog posts so we asked you what do you want to focus on? We said if you had one thing to focus on, acquisition, monetisation, what would you focus on? Give me more customers and logos! I don’t care how long they stick around or how much money I make off of them. We thought maybe we’re being unfair, we’re forcing them to make 1 decision, everyone wants to grow quickly and 100 units of time or dollars. Nope, give me more customers! It’s all I want, acquisition! But what’s scary about this is that what we found is that it isn’t the biggest driver of growth. We built this model based on the ton of data we’re sitting on – if we improve each of these levers by the same amount, what will be the impact on the bottom line? If we improve your acquisition, lead volume or conversion rate by 1%, what’s the expected outcome? You will see a 3% boost in your bottom line. It’s not bad – you spend time acquiring customers, you want to see an outcome. If we improve your retention by 1%, you will see a boost of just under 7%. If you improve your monetisation by 1% you will improve your bottom line by just under 13%. So the point is not to look at the individual numbers but improving retention and monetisation has 2-4 times the impact of improving your acquisition. But this is what we care about, this is what works.

The question was is there any data of venture back versus not? So this is a blend right now, it’s a good 50-50 blend, in this data set at least, because we wanted to see a variable and it wasn’t one on it. Churn, venture back companies is a huge lurking variable, we have the dataset I can share afterwards. Good question.

This is scary

So this should be a little scary, right? And I know I said I will make everyone feel bad including ourselves because we’re not talking to enough customers or doing this stuff either. But the reason this should be scary is that everything that you’re doing, particularly in a SaaS business, from your acquisition team all the way to your product and engineering is used to either drive someone to this point of conversion or justify the price you’re putting on your page. Your price is literally the exchange rate on the value you created. And if you’re not collecting any data about your customers, you won’t know who to drive to this page or how to price it. Those are pretty big problems.

How do we fix our monetization?

How do we fix this and get more practical about it? I promised we will make everyone feel good to pull us out of this trend we’re seeing.

A couple of things we look at; one is quantifying your buyer personas. We will go through that process and show you how to do that. It’s a little more of a process that I can teach in less than 20 minutes here but it’s definitely something you’re going to pull away the big pieces. And quite simply it’s putting together a customer dev process. A lot of us get caught up in things but we don’t have the process in place.

Let’s talk about quantifying your buyers personas. What I want to do is get you to a point where you can comfortably walk away and create the basic scaffolding of what your buyer persona should look like.

We’re gonna walk through a little bit of an example because we want to make sure that we know the buyer that we are going to build for and we know the buyer that we can actually sell for.

How do you know what to build?

So, we will talk about ProfitWell. I mentioned it before, we’re in a similar situation of Laura at MeetEdgar and we started off as a heavy technical service. You sold software but you had to buy us with it. We wanted to scale out so the first thing we looked at was ProfitWell. It’s a fun origins story. We were working with a company that were about to IPO on their pricing – we were in the room and it took us to realise that they were calculating MRR incorrectly. It seems it’s a simple thing and this was a CFO who had taken 2 other software companies public. But we were sitting there and thinking this is seriously wrong, right? Because it’s something they should have really really well done and it was wrong and we were like, holy cow, if this company that’s about to go public gets it wrong, maybe everyone gets it wrong.

Even further, when we started to explore a lot of people weren’t tracking their financial metrics. So we were like great, this was a huge idea we have and we got really excited and we looked at our mentors and how should we build this or focus on this? They were like, build slow, make 10 people really happy. So all we did was we focused on those 10 first people first and it did not look this good, it was awful, it was not great but we focused on just making them happy. When we launched this, about 2 years ago we put this out there, we made these 10 people happy and then we decided to go out to the market. We decided, ok we will launch this and get out there and it will take off. Let’s go subscribe to yacht magazines, it’s gonna be amazing, it’s gonna be phenomenal!

As soon as I sent the outbound emails, I get this. Oh, you’re like baremetrics just launched. Literally the same week. They raised money the week before and we were like dammit! Cancel the ferrari’s – it’s done! And what’s really disheartening about this is, they got the hacker news crowd like that. They launched and did a lot of transparency posts, there was a good network there. And it was, urgh, very downtrotting cause enterprise customers don’t scream that to the rooftops. They get excited but they’re not as vocal. And so we had all these vocal tweets about baremetrics and then we started to see some about ChartMogul. And we were like, crap, what do we do? We’ll what we did was we went back to the buyer personas. And we did a little research first and we realised there’s 37 other competitors to date, there wasn’t 37 at that point. But building on Stripe is super simple. We’ve now since gone beyond Stripe and it’s one of those things where there’s a lot of folks out there.

We were like well we know we’re better in some ways. Either Hubris or Ethos or whatever we had, we feel we’re better in some ways, we don’t have as wide of a product but we did was we stopped everything. Literally stopped everything and we went to these buyers personas. Cause we hadn’t done this work yet, we had just done the conversational customers development. We go to these buyer personas and were like, what do these people care about? And we used some of the tactics we’re gonna walk through right here.

Talk to your customer!

So the first thing we did, we went to the customer and it’s a big thing. I know its novel and you guys are pro at this, but you’re not talking to enough customers no matter what you are doing. And for the love of god, talk to your customers! Please, I’m pleading with you! We see inside so many different software companies and the ones that fail are the ones that no contact with what the customers are doing. It’s quite literally the biggest thing we can see in success or failure of companies.

So how do we do this? The process at a high level is not rocket science. First we’re gonna do is start with the shell of buyer personas cause again you guys have a basic concept of who your buyers are. It’s not like you’re completely starting from scratch. But even if you’re starting from scratch you still have some basic things you can use. We gonna set up an experimental design, we’re gonna collect some data in a very targeted way and we’re gonna go through that in a sec. And finally, we will consolidate and analyse that data and do this thing over and over again.

So what we do, are the first things we want to look at are these features. What are most and least valued? In our situation, we had a hypothesis, we knew making this accurate was really, really important. We also knew that was really hard to get right. So what we did is we went to our experimental design and decided what data do we need? We need a basic demographic data. We’re not talking about gender, height, those sort of things or about how many people are on your team, what other tools are you using, what metrics do you want to look at right now? When to feature package information, that’s actually do you care about x or about y and we will talk about that in a second. And ironically, pricing information is the easiest to collect. Seems more daunting but it’s much easier to collect.

How do we ask the questions? What do people value?

The two tools we’re gonna walk through, one is the relative preference analysis and one is the price sensitivity analysis. And you could use these two tools for a plethora of questions. Any questions related to value, you can use one of these two tools to figure out.

The first one we’re gonna look at is relative preference analysis. And it’s getting to the core of do people care about x, y, z or a, b c? And the way we do that is we don’t ask questions like this. If you take anything from this presentation is never ask a question like this ever again. We go back to bad surveys cause people hate surveys cause we’re bad at creating them and sending them. And this particular problem here is I don’t know what’s important. You send a survey like this to a sales or marketing person this is what you will get. I know it’s a gross generalisation but it’s pretty true. We’ve sent 20 million at this point and learned what different types of buyers are looking for. So instead of asking a question like this, you’re simply going to ask something like this.

So this is an open source and academic product that you use, it’s called Maxdif. It’s like diet conductive analysis. But what’s powerful about this is you’re forcing the respondent to make a decision. So now it’s not, oh I don’t know, they all gave me 8 or 9 or whatever it is but what is the most important thing out of this list and what’s the least? And the basic math, it’s fairly basic, I can share it with you afterwards or it’s in the slide resources if you want to download – it’s the results that look like this. All of a sudden, I know that this feature is more important than this feature and I also know magnitude which is important. Magnitude is important because you might have 5 features that no one cares about or have 1 feature that they really don’t like and then 4 features that people kind of care about.

And what’s powerful about this is when you break it down by a segment by segment basis. So you’re doing most and least here so at the end of the day, you start to see who cares about what. That’s a really important distinction, this isn’t we don’t have to have good uptime or build that feature, but I do know that for this particular subset, whoever is in this aggregate, that won’t be the number one thing on their marketing site. That might be something that I don’t put dev resources on. We can have 95% uptime and that’s ok and that’s an important distinction here because in dev mindsets and in marketing ones, depending on who you meet, sometimes there’s this notion that we need to do everything or everything needs to be good or it’s ok if nothing is good as long as it’s out there. This is where we can break down what’s important and not and we break it down in a segment by segment basis, all of a sudden we find that uptime, these big dogs, they do care about it. And they care about accuracy, actionability and uptime. The small folks, the early stage start ups, they don’t really care about accuracy – it’s all about price to them. We’ve heard that many times. And a beautiful design! If it’s beautifully designed and cheap – whatever that means – you got that crowd, right?

But all of a sudden, we looked at this, and to bring it to the case study here, what we found was oh this is interesting. We were getting ourselves down about our design and the depth or the breadth, but right now with these people, if it’s not accurate, actionable and down, they don’t care. When you break this down in a persona by persona basis, and there’s this assumption on who or what a persona is, all of a sudden we were like it’s got to be accurate, actionable and stay up – worry about price later. We’ll talk about that in a second. But it’s one of those things where all of a sudden is we don’t want the hacker news crowd. It would be great if they could use the product, but we will say no to them right now and focus on the middle price person.

It’s tough, right? Cause it’s qualitative until it’s quantitative. There’s a couple ways you could measure fiscal significance with this kind of data and fiscal significance it’s not a set number. I would say if you’re in a very saturated space with a type of customer, you could get by and it’s not gonna be perfect with as little at 50 responses per segment, but we were working on a qualitative basis here for this data. We just want to get 30-40 per segment and some of these we input the data ourselves based on the conversation but to do this at scale, it’s not a set number but if I would have to – at least 100 responses per segment. If you’re an enterprise company you can use the methodology. It’s a great sales tactic, what’s the most or least important to you? It’s giving you some directional information – it’s a great question!

So what we do or can do, we didn’t do this in the beginning, is you can use it across most of your features. You might have a main or parent category where we will compare support, data integration and call them action tools but you also have under-support or if you chose support, what’s the most important and least so? The reason this is important is you don’t want to send out 1 question like support is so important – when in reality live chat would be fine. So we recommend starting small and just ask 1 question but always know what the data is in context. If you don’t have a big enough sample size, then it’s qualitative at worst or at best directional data. If you do have one, maybe you need to dig further under the assumptions you’re seeing. The other thing is making sure you break this down amongst your demographics and personas. That’s super important because every single survey you send, and we don’t have a researcher on our team, you might be able to ask 1 question per quarter – make sure you have it all centralised so you don’t come back 18 months later and figure out wait, we already asked this question and the data might be old but it’s a starting point for that future question.

With this, we figured out at least on a higher level what start up Steve cared about. What we were focusing on was we knew all of a sudden if we would continue working on this product we needed to focus on accuracy until it’s done and we needed to make sure that it was accurate at all times. To skip to the end, we continued until the end and it paid off seeing the data and output.

How much are they willing to pay?

On the other side of the coin, pricing. So we were like we know it needs to be accurate, and actionable and that will take a long time but we knew it was a guiding light – but in terms of pricing, we wanted to look at how much people are willing to pay. It’s not that hard, you just have to ask. And I know a lot of people say it’s bad – you just have to ask in the right way. In human beings we think in value, people way smarter than me figured it out, that value is a spectrum. I know that this podium is worth less than this entire building – it’s not a hard concept to get. But we can take advantage of that by asking questions about pricing in a targeted way. And the reason this is so important is because we have these different axis that we look at. So features are tough – but price we can go to the right personas and make sure we align a different persona to each of these different tiers. And the questions we will ask – this is based on an economic model – it’s in the resources. But the basic thing is ask at what point is this way too expensive? All the way down to and most importantly for a lot of our businesses, at what point is it too cheap that you question the quality of it? It’s cool cause it gives you output like this. You can do this in Excel, don’t worry! Each of those questions corresponds to one of these lines – so at what point is this getting expensive, a good deal and too cheap? The translation of the data is the elasticity curve which compares sell point to % of sales lost. It’s not all of a sudden if I collect this data on any of your products or an aggregate, I would know if I move my price to 500 from $400, I will lose this chunk of people. You could do a basic calculation or you might find we’re priced down here, that’s why we’re losing all these sales.

People think we’re too cheap. I have many people who doubled their price and conversion rate because people took them more seriously. That’s a bigger problem than overpricing although there’s many problems there as well. But we found here for us with some dismal news, we looked at the willingness to pay for a SaaS metric solution amongst these personas and down here, hacker news crowd not much. These are the annoying customers, I want everything and it needs to be free! But what was scarier was not that, because we all heard about that. The bigger problem was up here. If you look up here, $50-100 a month we get it. But this price didn’t scale effectively. We were expecting – if you’re in a good market, the scale for a B2B market you should be looking at much more than 5x from bottom to top. So you’re looking at a 5x and it’s not great, right? That means that an established and growing company is not really willing to pay much for your product relative to your small company. I don’t know if anyone tried to build an analytics product but retention is the worst. Their retention curves bottom out near 20% or that was the rumour – that means in 6 months you’re losing 80 out of 100 customers you bring in. So we’re not gonna make money off of them and they will leave us – this will be a disaster! We were like maybe we stop billing. We had some different hypothesis about other products because at this point, we’re starting to see different data points with these customers.

But before we get there, what we did was plugged this in and the really hard conversation we had is when we estimated CAC and LTV – anyone who knows it, CAC is customer acquisition cost, LTV is lifetime value. Basically you want an LTV to CAC ratio of 3 or more meaning for every dollar you put into your business, you get 3 dollars out. Our LTV to CAC was underwater and we were losing money on people. The start-up world it was one basically and so I was all right, there’s no business here.

What do we do? So we do have some inklings – the first one is on churn recovery. We asked people listen, what if we build this product, and we had screenshots and things like that and we found holy cow, things scale pretty well. If we could say basically we lowered your churn by this amount, what is your willingness to pay? The median here is $100-150. A company that wasn’t willing to pay 50 bucks was willing to pay 150 if we reduce their churn. Then some of these big dogs got some 4 figure MRR which is impressive. And then all of sudden you were like revenue recognition – this was another problem we heard about with these folks. And the willingness to pay again, the small folks didn’t care because they don’t do crew accounting – the larger folks it’s a huge problem. It was qualitive data we got but what we realised – this was before we continued on because we had that point of oh crap, we’re done – is that we found had a solution if we wanted to pursue it. So we made it free, you can go in and plug in this metric system and get it for free. It’s accurate and now is well designed. It wasn’t before – but for us, why we did this, it’s got low CAC and we’re providing value. So we’re still fighting a retention war around active usage but it’s where I don’t have to pay you 1 dollar to get you through the door. It’s something that’s relatively easy, we can get you through and we’re providing constant value so that maybe you won’t buy from me in the next month but maybe six months, twelve months down the road, I own you as a lead, potentially.

In addition to that, we have path to share of wallet. I can show you you have a problem with churn and I can give you a product you can instantly turn on and all of sudden with give you a solution to churn.

And then finally it creates the requirement which is kind of a similar concept but basically we can go in and say we’re partners in your business and we can help you. You know, here are the things you should be doing or here are the things you need to be doing, basically be a coach to a lot of these different users.

And for monetization, right now, we’re looking at retain which is the churn product and revenue recognitions which basically solves a ton of work people have on their finance team. And what’s really kind of fascinating about this, is the underlying data point that was always in the back of our minds that I haven’t really shared as yet, is that right now there are only 15,000 SaaS companies in the world right now. That seems like a disastrously low number and it is. If you add subscription businesses, media companies, things like that, you almost get to maybe 50,000. And we’ve done a lot of work on trying to estimate this market, and even if we’re wrong by a factor of two or three x, we’re still not talking about a million different businesses that we can access. So that was a big contributing factor to making profitwell free was because we know we need a really high share of wallet and so for the smaller folks, we get them through the door, we’ll figure out how to get them to grow, and if we get them to grow then they might want to use our tools. And for the larger folks, we’re gonna basically create the requirement for them already out of the gate.

12 hours total

So what’s amazing about this is, all that work I just showed you took 12 hours and cost us $2,100. Putting this up here and technically we do this for a living, lets assume I take 24 hours for you in aggregate, but this doesn’t take a ton of time to do. It’s something you have to be doing in your business, collecting this type of data, or at least having these types of conversations with your customers.

Implement a pricing process

The big thing here though is this is a process. This isn’t a one or done type of thing. You really need to be collecting some sort of data, we recommend on a quarterly basis. And that’s because you should be evaluating or making changes to your prices every 3 to 6 months. Now I’m not talking about the actual number on the page, but it might be hey we’re putting this feature here or pulling this feature out as an add-on, maybe you are lowering your value metric, the unit of value you charge on. You’re doing something to change up your prices. Because it is that important you need to treat it similarly to your product development cycle. And one big thing we always say is that if you’re improving your product you should be improving your price because remember prices is the exchange rate on that value you’re creating.

So to do that we recommend following a pretty straight forward process here where someone dedicates maybe 20% of their time, it doesn’t have to be 100% of their time, but they’re the main point of contact, the main liaison internally for pricing. You have a meeting at the first week here, maybe it’s your pricing committee which we’ll talk about in a second. Over the course of those weeks, that person, he or she, goes out and basically focuses on this is our problem we need to figure out how to spur more annuals or hey we need to figure out where this feature should go or do this as an add on or we should include it. And then that person comes back in week 4 and basically says here is what we found let’s make a decision. You make a decision. Depending on the impact of that decision, you might need to create a communication plan or if it’s really major you might need to go back out to your customers and verify this is the right decision to be made. And then you implement. And then next quarter it’s a different problem.

Pricing Committee

Typically, folks that should be involved, depending on your size, if you’re really early on normally it’s just a couple of founders that are in the room. For the other folks that are a little bit larger, you do want some representation from product, sales, marketing and corp dev and finance. We typically recommend the main point of contact should not be in Finance or sales. I’m going to make some gross generalisations, but typically sales folks always want lower prices and then finance folks really like to work on their spreadsheet – you know, if we just do this then growth will be amazing! Well, we need to talk to the customers so…And then the normally the main decision maker, they don’t necessarily need to be involved in the committee but there does need to be some sort of decision maker. Pricing, a lot of us are not used to doing this on a regular basis so there needs to be someone and a date on a calendar that says we’re going to make a decision by this date and by this person because you might get into analysis paralysis and just not focus on it.

Monetization matters

But the big thing here today, this kind of stuff matters.

- Your customers matter.

- Monetization matters.

It’s something you have to focus on in your business mainly because it’s getting harder and you don’t want to make it harder on yourself.

Thanks guys!

Learn how great SaaS & software companies are run

We produce exceptional conferences & content that will help you build better products & companies.

Join our friendly list for event updates, ideas & inspiration.

Q&A

Audience Question: So we’ve got about half of our prospects who when we give them our pricing they’re like wow that’s amazing and where has the product been all my life and here’s the money flying out of my wallet. And the other half saying how can you possibly have the audacity to charge for that. I get generally the idea would be to segment who is saying what in order to triangulate, in order to figure out…generally 50% say it’s too cheap, 50% say it’s too expensive. What would your advice be in order to help reduce that

conversation so that I have less of those kind of conversations?

Patrick Campbell: ok, so the question is, you have 50% people hate your price, you have 50% who fell you are too cheap, meaning like they are buying it without any friction. There are a couple of option. 1 if you truly feel you have 50/50 and there’s some lurking variable that you can figure out then you could probably objection hand and figure out how you can get that other 50% happy, my gut which is always dangerous, tells me that that other 50% you shouldn’t worry about. Because the danger is, instinct is lets lower our price, let’s get under a threshold where that other 50% is comfortable. And there might not be a threshold. It might be that they just aren’t. There are certain subsets of customers who are just awful to sell to and there is some reason and it’s your job to kind of figure that out and you can use some of these tools to basically find that. Good question.

Audience Question: Could you talk a little bit more about the data collection part? Especially when you target higher level managers, how do you access them to fill out the surveys and give you the data?

Patrick Campbell: Yeah, what’s really funny is there are like…so one, depending on your list size, so like enterprise companies you only have so many VP of marketing folks in fortune2000 companies lead list, right? There are companies out there, there’s one called astro target market, there’s fulkrom, there’s others where they can get you access to anyone from a soccer mom or dad in the middle of Kansas all the way to a Fortune 500 CIO. One costs a little bit different than the other but it’s one of those things where there really are no excuse for collecting the data. Now what I would say is that if your deal size is very contractual, very negotiation, then you probably just want more of the packaging type data and then a general sense of where your price point is. And you can do that…it’s a little archaic but a little bit more guess and check than actually collecting this type of data. But I’d recommend 1. Use your lead list, do interface conversations if you need to but if you’re at a point where you need to collect data because there’s a huge risk because keep in mind that data we collected shaved 6 to 9 months off our development process and also made sure we weren’t making a huge mistake so that’s why sometimes it’s worth it. You may be paying 25 bucks per response but you’re saving yourself a ton of time and money in the long run. Good question.

Audience Question: If you were starting over today would you bother to build Profitwell at all or would you just build the retain and revenue piece or is it useful enough as a marketing tool? Would you build it first or would you build it all?

Patrick Campbell: If I was starting off completely overall I would still build Profitwell first but even before price intelligently. So the price intelligently business, I didn’t speak a ton about that, but I mean it’s clunky, it’s like a tech enabled service. In our opinion we do really great work but it’s one of those things where we don’t have a constant interaction with our customers. We might end up doing something for 8 weeks and then they don’t go for basically the partner option which continues our interface. So at Profitwell though, just given the amount of time that we can interface with people on that platform, we treat it as a platform, the future is that Profitwell we are going to put Price Intelligently on top of it whether that this still is these larger scale deals where there is still going to be an interaction after we do them or it’s gonna be automated and productised down so that we have this little suite. But if I was going to stay in SaaS, I would build Profitwell first, mainly because there are only 15,000, and it’s growing but it’s growing about 3% per year, logos. The revenue is growing astronomically and that’s also why some of the products that we’re building the pricing is tied to revenue rather than tied to…your revenue or revenue recovered. That’s a good question. I may not stay in SaaS, like meta SaaS

Audience Question: Data collection again, sorry. Did you just ask customers or prospects that had declined to become customers or qualify prospects cos surely whoever you ask you’re gonna get a different price point for your max and minimum. And also with your existing customers don’t they always have an incentive to give you a lower price?

Patrick Campbell: So really you should be collecting it from 3 different main subsets. Prospects, customers, people who’ve never heard of you or your target customer. And the reason for that is you hope…the point about customers not necessarily giving you the right information, the model built in there, the range model accounts for that and obviously you take out liars. So you’re gonna get some assholes who are like one dollar, one dollar, one dollar. I can see your data and take it out of the data set – it’s not that hard, right? The model also accounts for it. We’ve 20 million users at this point. The basic model is plus/minus 7 on target in reality and then in our model we’ve improved a lot on that to a kind of open source model. Back to the real answer though, prospects, customers and target customers who’ve never heard of you. Because you want that web of data, right? And what’s really fascinating is that those people who haven’t really heard of you, they’re gonna really test your messaging and marketing cos you’re gonna give them an example of what you’re trying to sell them and all of a sudden they’re like well if you solve that problem this is my willingness to pay essentially. But if I was going to make a pricing change those are the three levels you want to collect from. Good question.

Learn how great SaaS & software companies are run

We produce exceptional conferences & content that will help you build better products & companies.

Join our friendly list for event updates, ideas & inspiration.